We often are asked by entrepreneurs how we find startups to potentially invest in (in essence, our deal flow). The ways in which an entrepreneur might best connect with venture capitalists has been covered by a number of other VCs across the web, but we thought it might be helpful for entrepreneurs to put this question into context by providing actual operating data regarding deal flow for our firm. As part of our process, we keep a detailed summary of the industry, source and quality ranking of each company we evaluate in any given quarter. To put last year's data into context, we were introduced to the management teams of several hundred companies during the course of the year and invested in five new companies. We've been tracking this data for several years, and based on this, we put together three tips that we hope will help you engage with a VC.

1. Know What The VC Likes To Invest In

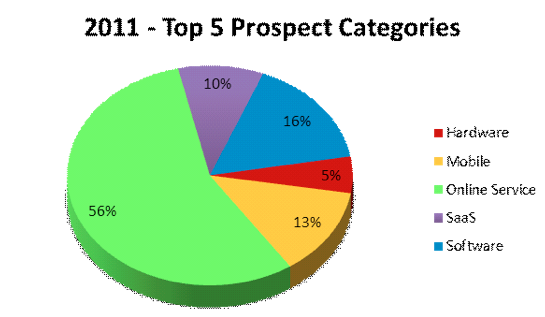

One of the metrics we track is the broad industry segments of the startups we review each quarter. We like to categorize startups by the industry they fit in, and as you can see from the chart below, our primary focus has been on five key areas.

As an entrepreneur it is important to know what categories a VC focuses on. The two categories that you don't see on our list are Cleantech and Medical Devices. We don't invest in these two areas, and yet we still receive requests to look at startups that fall into those categories. Take a quick glance at the portfolio and website of the VC you are potentially reaching out to; if you don't see any investments that match your industry, you're most likely better off spending your time engaging with firms that actively pursue companies in your respective field.

2. Know Where The VC Looks For Great New Companies

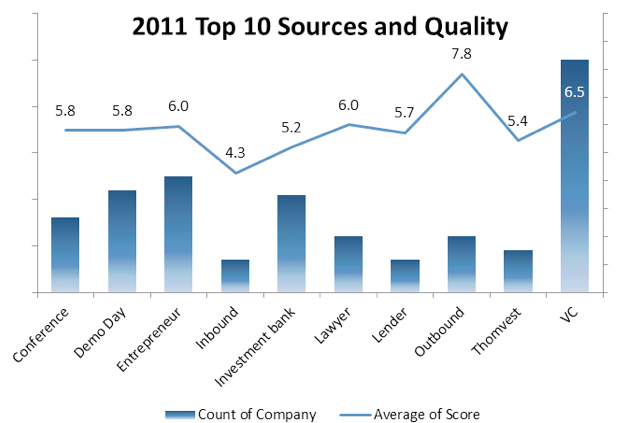

We focus heavily on which types of individuals send us the best deals and what the average quality scores are of the companies they send us. We break this out by source type and quality score based on our 10 point initial review scale. For an explanation of our initial review scale please see our prior blog post here.

Of our five new investments in 2011, three came from other VCs, one from another entrepreneur, and the last from our outbound efforts on AngelList. The takeaway for entrepreneurs: the way you are introduced to a VC really matters. If another entrepreneur, VC, or industry contact whom we have a relationship with asks us to look at something, chances are fairly high that we will look at the opportunity. Like a lot of firms, we do not do take many meeting requests that come to us via a cold email (inbound). While it isn't a guarantee that a VC will invest, gaining a "warm" intro will often get you the first pitch meeting. We recommend cross-checking your contacts on Linkedin and figuring out which of your colleagues or advisors may know a VC that you would like to meet with, then asking for an introduction. This simple act will pay dividends in terms of making it to the next step of a pitch process. If you don't have an extensive list of contacts, the other options include going to conferences, demo days, or using AngelList to get your foot in the door.

3. Know The Right Time to Contact (and When Not To Contact) a Potential VC

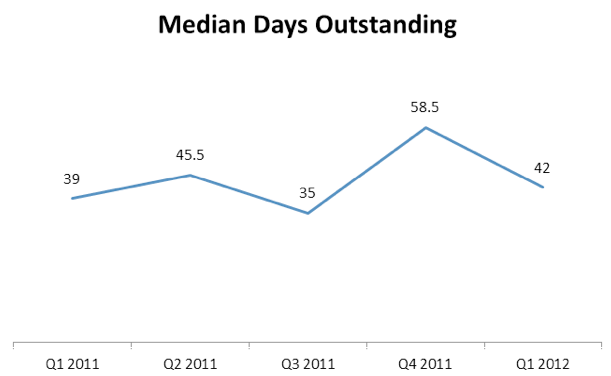

We try to get back to every entrepreneur with feedback. The vast majority of the time we unfortunately have to say no, but we try to let the entrepreneurs know our honest reason(s) for passing on their company -- at the very least they will walk away with one VCs candid objections and incorporate what we hope is useful feedback as they build their business. We also measure the days it takes for us to respond to entrepreneurs we meet with during the course of the year, and the days outstanding for 2011 are below.

Given the number of companies we see it sometimes takes time to understand a given opportunity, discuss it internally, and provide candid feedback to an entrepreneur. We have found that many entrepreneurs appreciate the constructive feedback. One thing we have noticed that doesn't work with almost every VC is frequent emails requesting to know the status of "where they are at" in terms of making a decision. If a VC really likes what you are doing, they will be quick to respond. Unfortunately, the common practice of many VCs is to go radio silent. While this can be frustrating for an entrepreneur, doing some initial qualification of the firms and the individuals you are targeting up-front can help mitigate against being caught in this type of void. When following up to check on the status of a review, we also recommend including any significant company updates you might have (closed X customer, increased revenue by X), or if your funding round is becoming oversubscribed and you want to give a courtesy note with the timing of the round closing. Nothing impresses us quite so much as execution and communicating progress to VCs while they are evaluating a funding round not only demonstrates the viability of the company's business, but can also engender the sense that if we (or any other VC) don't jump on a given opportunity, then we might lose out to another VC.

We hope this gives you an idea of how to think approaching and engaging a VC. Feel free to give us any feedback or ask any questions you might have.