Walmart, the quintessential American retailer, is racing to catch up with the reality of Americans’ changing shopping habits.

Fewer Americans want to park their cars in giant lots and schlep to a big box store. Amazon.com and other online sites have made brick-and-mortar outlets with a wide array of items less necessary, while those items people require now can be easily picked up at smaller shops.

At the same time, a growing percentage of Americans live in cities, not Walmart's traditional turf. Between 2000 and 2010, the urban population increased by 12.1 percent compared to overall population growth of 9.7 percent, according to U.S. Census data.

The evidence of the new retail world was all there on Thursday when Walmart announced its sales for the previous three months.

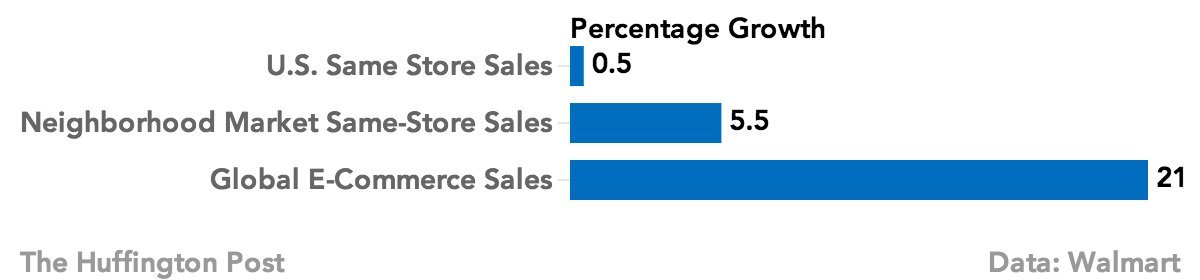

For the first time in nearly two years, same-store sales at Walmart U.S. were up, rising 0.5 percent during the 13-week period ending Oct. 31. But sales at the chain's smaller neighborhood market stores, typically located in more urban areas, were up 5.5 percent. And the real star was online sales, including through the Walmart app: They were up 21 percent.

Clearly the growth is online and in small stores -- though that doesn't mean Walmart is walking away from the big box. Instead, the company sees these newer parts of its ecosystem as complementary to its traditional core business, said spokesman Randy Hargrove. Shoppers can stock up at supercenters and then use the neighborhood stores for spot needs, he said. Or they can shop online and pick up items at a physical Walmart.

"Supercenters are going to continue to be a very valuable part of how we do business," Hargrove said. "It's about getting closer to the customer, giving them the opportunity to dictate how they want to shop."

Indeed, supercenters still represent the bulk of Walmart's business. As of Oct. 31, the retail giant had 3,871 supercenters and discount stores in the U.S. and 431 neighborhood markets.

But the company is investing heavily in revamping its website and mobile apps. It has acquired more than a dozen technology companies in the past year, largely to poach talent.

Walmart has also been trying to extend its low-price mantra to the Internet, launching an online price-matching service earlier this year and offering its first Black Friday deals at Walmart.com just after midnight.

Stores will even match prices from Amazon, Walmart U.S. CEO Greg Foran said on a call with reporters Thursday. That announcement formalized a policy already in place at about half of its stores, he said.

In addition, Walmart is aggressively expanding its neighborhood market stores. The chain plans to add more than 170 such stores next quarter, Foran said on another call with analysts.

All of that may not be enough to turn Walmart’s U.S. business around. A note from analysts at Wolfe Research, published Wednesday before Walmart's earnings release, pointed out that the supercenters are plagued by competition from Walmart.com and nearby stores, staffing levels that are too low, and Walmart’s waning ability to crush competitors like Kroger when it comes to price.

“While the company has noted it has the time and the intestinal fortitude to fix its business, it appears it will cost a lot to really turn around the core supercenters,” the note said.

The elephant in the room continues to be Walmart's customers, who are still struggling to come back from the pain of the recession.

"Its core low-income consumer has been under pressure throughout the Great Recession and ensuing recovery, seeing little in the way of wage gains," Ken Perkins, the founder of data firm Retail Metrics, wrote in a report published Tuesday.