The underlying assumption that the current world monetary system is built upon is that America will always over-consume and the world will always accept our debt at face value. It's a warped and unhealthy relationship, but its worked (sort of) for several decades. That's why it was notable when a Chinese central banker spoke up last week.

"The United States cannot force foreign governments to increase their holdings of Treasuries," Zhu said, according to an audio recording of his remarks. "Double the holdings? It is definitely impossible."

Impossible? That's absurd. For decades foreigners have been more than willing to exchange their excess dollars from trade surpluses for our debt in order to keep their currencies at artificially low levels.

It turns out that the problem isn't foreigners' willingness to lend to us.

"The US current account deficit is falling as residents' savings increase, so its trade turnover is falling, which means the US is supplying fewer dollars to the rest of the world," he added. "The world does not have so much money to buy more US Treasuries."

The problem is that the American middle class is broke and unable to continue to over-consume.

The current global monetary system is known as Bretton Woods II. The idea is that the world uses dollars it receives from trade surpluses with America for its purchases from third-party countries of commodities that are priced in dollars, such as oil.

Once global trade is satisfied, these dollars are reinvested in America in the form of bond purchases. This allows America to finance its enormous debts at artificially low interest rates. Also, by purchasing American debt, it artificially inflates the dollar, thus allowing the American consumer to purchase goods at artificially low prices.

With their artificially suppressed currencies, Asian nations were able to put millions of people to work in factories producing goods for export to America.

Through the years some people questioned whether foreigners would continue to purchase debts that America obviously will never be able to repay. Yet year after year the foreigners continued to play their part in this prisoner's dilemma.

However, while no one was watching, the other side of the equation was breaking.

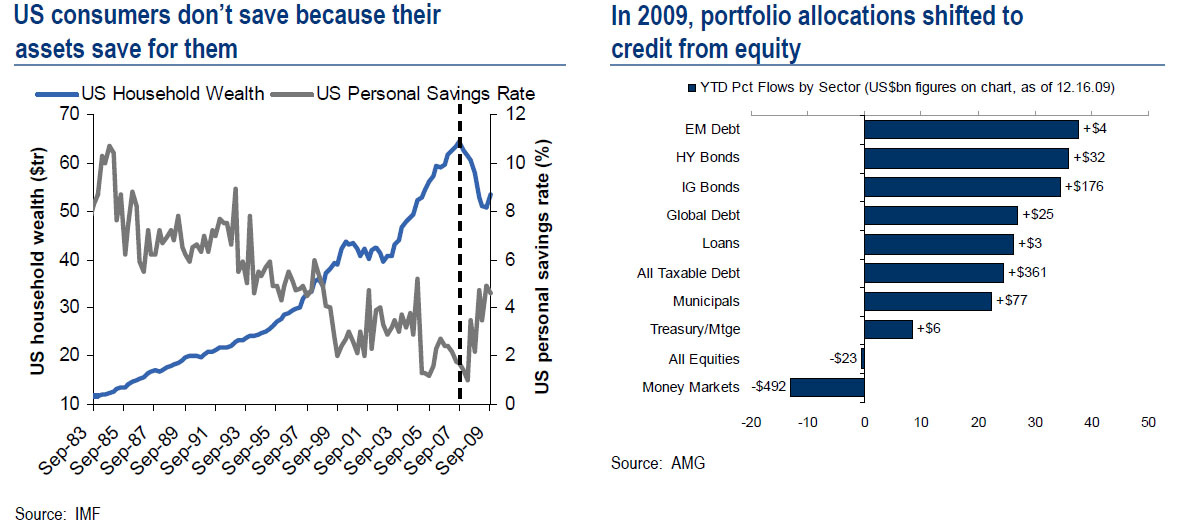

The artificially low interest rates in America led directly to asset bubbles. These asset bubbles were used to mask the fact that wages weren't keeping up with living standards. Our manufacturing base was being put out of business by the artificially high dollar.

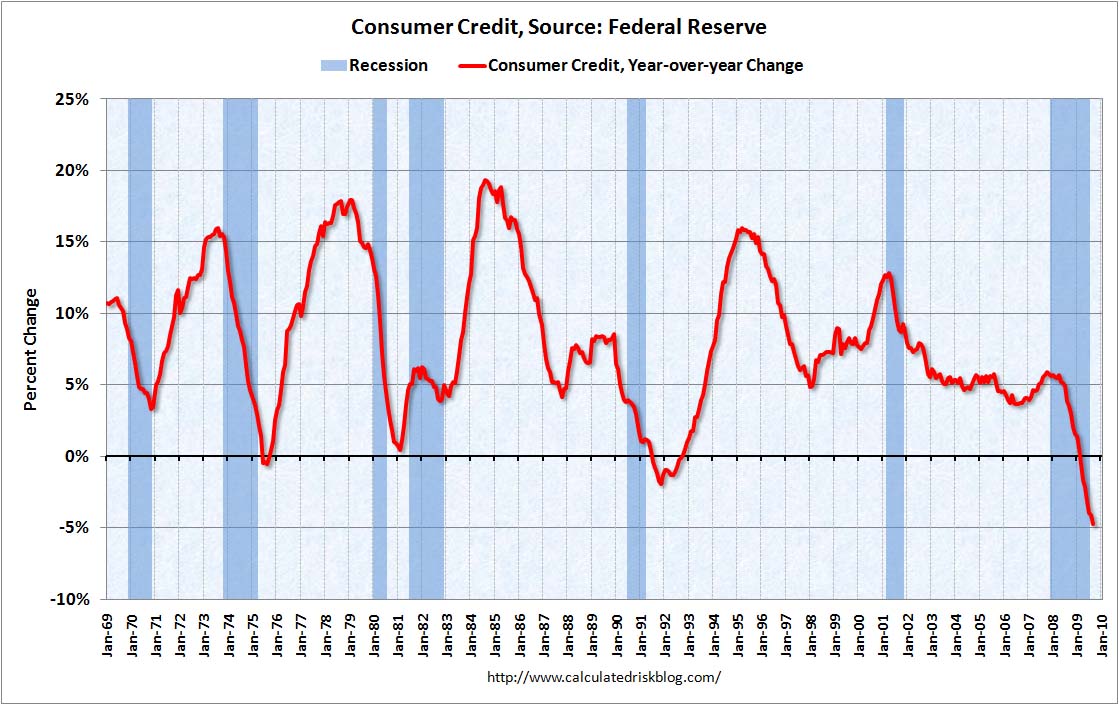

The American consumer borrowed against these inflated assets, primarily houses, to live a lifestyle that their wages couldn't support. When multiple asset bubbles popped in 2008, the American consumer no longer had an asset to leverage against, and banks, in order to survive, had to cut back on consumer credit lines.

Suddenly one side of the Bretton Woods II monetary standard -- America's ability to over-consume -- was busted.

"Foreign Central banks aren't going to finance much of the 2009 US fiscal deficit; Their reserves aren't growing anymore."

- Brad Setser, Council on Foreign Relations

At this point, the American government stepped in. Instead of trying to address the source of the problems with the economy and put Americans to work, the government tried to re-inflate the consumption bubble with programs like Cash4Klunkers and HAMP. Except for some extremely short-term results, these expensive programs have completely failed because they have only addressed the symptoms rather than the disease.

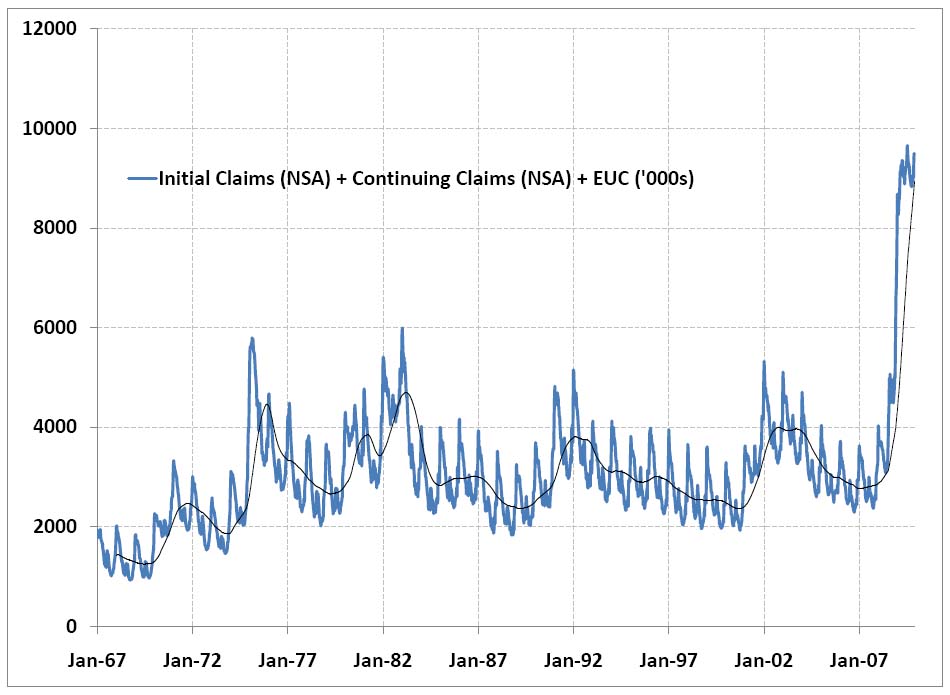

Real Unemployment

All this government borrowing adds up.

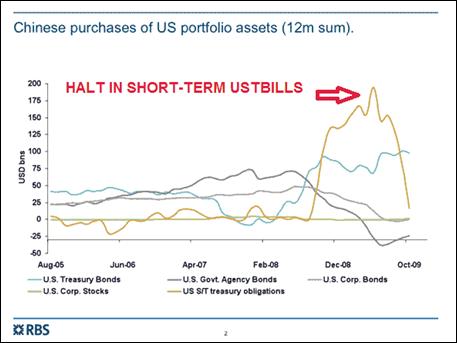

As the world watched America go on a borrowing binge unprecedented in the post WWII era, their first response was to roll their long-term dollar assets into short-term assets as they expired. This reduces risk for the lender, plus reduces rates for the borrower.

However, it causes a potential problem for the borrower -- America -- because it requires an increasingly large amount of debt that must be rolled over every few months. If, for whatever reason, there is an unexpected, short-term financial crunch, then it can quickly become a crisis.

The more fundamental problem with this "solution" of government borrowing replacing consumer borrowing was largely unmentioned until Mr. Zhu brought it up last week. It's relatively easy to finance a $400 Billion budget deficit when the trade deficit is also $400 Billion. The trade deficit dollars get recycled as is normal.

But how do you finance a $1.4 Trillion budget deficit when the trade deficit is only $300 billion?

You have to get the money from somewhere else. For a couple of months we can issue our debt in short-term bills to match our foreign creditor's desire to reduce their risk. This will only mask the problem, and in fact, its already run out.

"It would appear, quietly and with deference and politeness, that China has canceled America's credit card," Kirk told the Committee of 100, a Chinese-American group.

Instead of buying American debt, China has gone on a worldwide shopping spree for natural resources, and spent another $586 Billion on themselves to stimulate their economy. China is also making currency swap agreements with other nations, so it no longer has to use dollars in its foreign trade.

Or as Bank of America put it:

The financial crisis delivered a clear verdict, in our view, on the limits to the Asian growth model. It no longer makes sense to pursue double-digit growth by lending cheaply to the US consumer.

"Confidence in the U.S. dollar is 'fraying' and a shift away from the greenback after the financial crisis is inevitable."

- Nobel Prize-winning economist Joseph Stiglitz

It begs the question -- where will the money come from?

Sometimes people ask that question, which is a very good question, but stop there.

An even better question to ask is -- is there enough money?

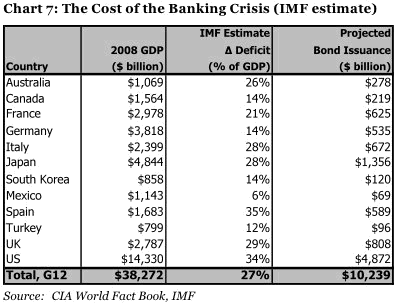

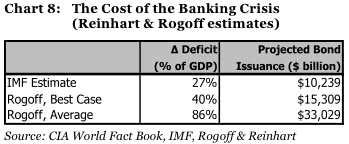

The IMF, which has repeatedly underestimated the economic crisis, has produced some numbers which are scary in and of themselves.

Fortunately, Carmen M. Reinhart and Kenneth S. Rogoff have studied dozens of historical examples since 1800 and tried to answer that question by basing it on what that history teaches us.

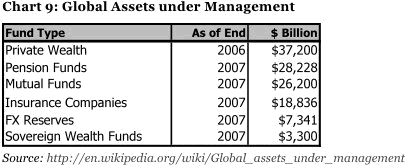

If you are like me, $33 trillion are so far above my ability to imagine that they may as well be using another language. That's why it is important to put things into perspective by comparing this number to other asset classes.

If you understand the significance of these numbers you have arrived at the "Oh, shit" moment. The amount of money required to bail the world out of the current economic crisis, if this crisis plays out at a historical average, is nearly equal to all the private wealth currently in the world.

To repeat the obvious, this doesn't add up. What about the capital needed to fund the businesses of the world? What about the capital needed for private consumption?

There is no "what if". The odds of all this deficit spending getting financed at an affordable rate is zero. It's simply not going to happen. You can close your eyes and cross your fingers. You can pray to your Gawds. You can chant "I believe" all you want, but at the end of the day the laws of supply and demand will win.

Once you wrap your mind around this horrible fact, you realize that we are in for a world of hurt.

There are only three possible outcomes: 1) interest rates skyrocket to crushing levels, or 2) the central banks print money on a massive scale, or 3) some combination of the first two choices.

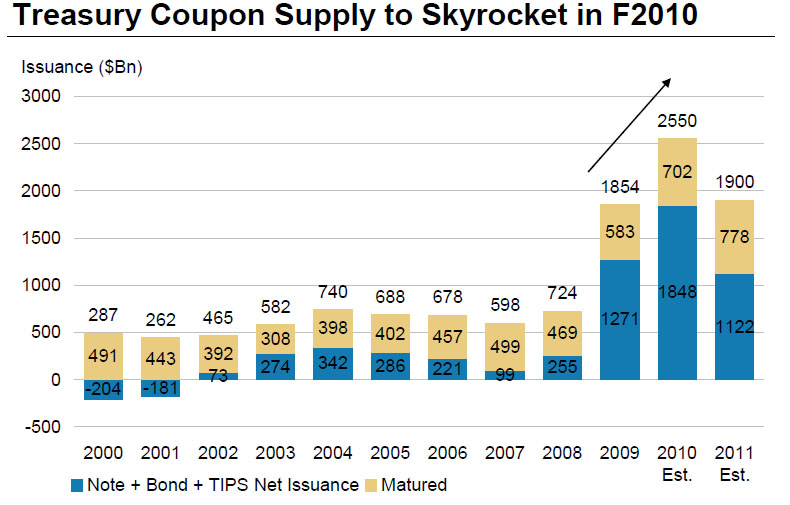

ZeroHedge does the math.

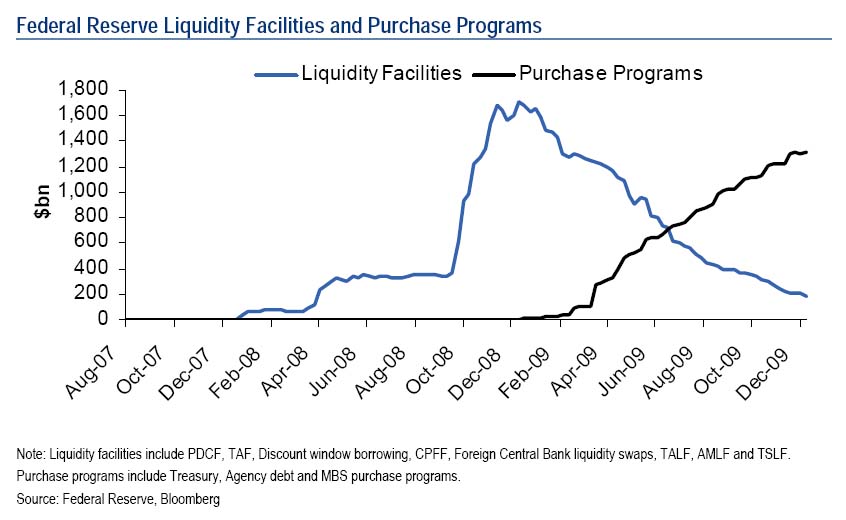

Accounting for securities purchased by the Fed, which effectively made the market in the Treasury, the agency and MBS arenas, but also served to "drain duration" from the broader US$ fixed income market, the stunning result is that net issuance in 2009 was only $200 billion.

Out of the $2.22 trillion in expected 2010 issuance, $200 billion will be absorbed by the Fed while QE continues through March. Then the US is on its own: $2.06 trillion will have to find non-Fed originating demand. To sum up: $200 billion in 2009; $2.1 trillion in 2010. Good luck.

The Federal Reserve, the lender of last resort, has also become the buyer of last resort.

The Fed stepped into the mortgage market is a very big way.

In other words, the Federal Reserve alone bought $722 billion of mortgages and agency debt when only $686 billion in new mortgages were issued. So, through August, the Fed bought more than 100% of the entire supply of new (purchase) mortgages in 2009.

The reason for this is three-fold: 1) foreigners began dumping Fannie Mae and Freddie Mac bonds the moment the Treasury had to nationalize these agencies, 2) no one trusts our mortgage-backed securities anymore, and 3) the desire of Washington to bail out Wall Street via re-inflation of the housing bubble.

The Fed has already purchased over $1 Trillion in mortgage-backed securities and it is approaching its self-imposed limit.

On the other side of the scale was the Fed's completed purchase of $300 Billion worth of Treasuries. Yet despite the Fed's monetization being over, interest rates remain low and the auction bid on Treasuries remain high.

It brings up the question of who is buying all these Treasuries?

the United States increased the public debt by $1.885 trillion dollars in fiscal 2009. According to the same report, there were three distinct groups that bought more than they did in 2008. The first was "Foreign and International Buyers", who purchased $697.5 billion worth of Treasury securities in fiscal 2009 -- representing about 23% more than their respective purchases in fiscal 2008. The second group was the Federal Reserve itself. According to its published balance sheet, it increased its treasury holdings by $286 billion in 2009, representing a 60% increase year-over-year.

So who is the third group that is buying all these Treasuries? It's you and me.

US households purchased $529 billion of US Treasuries in the first nine months of 2009, accounting for 45% of total new Treasury issuance.

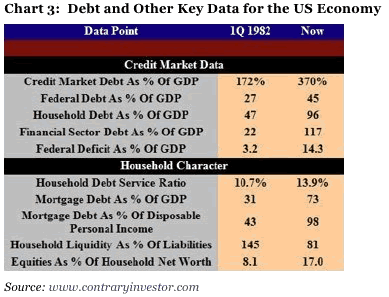

Wait a second. Something is wrong with this picture. The balance sheet of the American household is in terrible shape.

Unemployment is at post-Great Depression highs. Even people still employed are working fewer hours. The bursting of the housing and stock bubbles has devastated the investment portfolio of the American family. What's more, the "Household Sector" is outside of mutual funds, money market funds, pension and retirement funds, and life insurance companies.

So how does the "Houseshold Sector" go from purchasing $15 Billion in Treasuries in 2008 to purchasing $528 Billion in 2009?

We discovered that the Household Sector is actually just a catch-all category. It represents the buyers left over who can't be slotted into the other group headings. For most categories of financial assets and liabilities, the values for the Household Sector are calculated as residuals. That is, amounts held or owed by the other sectors are subtracted from known totals, and the remainders are assumed to be the amounts held or owed by the Household Sector. To quote directly from the Flow of Funds Guide, "For example, the amounts of Treasury securities held by all other sectors, obtained from asset data reported by the companies or institutions themselves, are subtracted from total Treasury securities outstanding, obtained from the Monthly Treasury Statement of Receipts and Outlays of the United States Government and the balance is assigned to the household sector."(Emphasis ours). 10

So to answer the question -- who is the Household Sector? They are a phantom. They don't exist. They merely serve to balance the ledger in the Federal Reserve's Flow of Funds report.

Our concern now is that this is all starting to resemble one giant Ponzi scheme.

The fact that the Treasury can't actually identify the one of the largest buyer of its debt can't help but raise a few eyebrows.

Can you imagine a private company that couldn't identify its largest customer? Can you imagine a government who couldn't identify its largest creditor? Oh wait...It's beyond suspicious.

Are these phantom creditors hedge funds? Probably not.

It makes a person wonder if the Fed and/or Treasury hasn't been involved in either some shady accounting tricks, or hidden monetization of debt. Even if the these are legitimate investors, is it realistic to expect a savings-poor America will increasingly buy these Treasury bonds that yield almost no interest?

The math is clear -- there isn't enough money in the world to fund these massive deficits, at least not with the current monetary system. So it would not surprise too many people to find out that the government is taking extreme measures to balance its budgets.

Remember, you can't spell "confidence" without "con".