NEW YORK -- Top executives at Washington Mutual actively boosted sales of high-risk, toxic mortgages in the two years prior to the bank's collapse in 2008, according to emails published in a wide-ranging Senate report that contradicts previous public testimony about the meltdown.

The voluminous, 639-page report on the financial crisis from the Senate Permanent Subcommittee on Investigations singles out Washington Mutual for its decision to champion its subprime lending business, even as executives privately acknowledged that a housing bubble was about to burst.

"I have never seen such a high-risk housing market," CEO Kerry Killinger wrote in a 2005 email to his chief risk officer. "This typically signifies a bubble."

Nonetheless, in a series of memos over the next two years, Killinger told board members that the bank should accelerate its subprime portfolio as part of a major growth strategy.

The internal memos detailed in the report are a stark contrast to Killinger's testimony last year before the same Senate subcommittee, where he said that by 2004 the company "quickly determined that the housing market was increasing in its risk, and we put most of those strategies for expansion on hold."

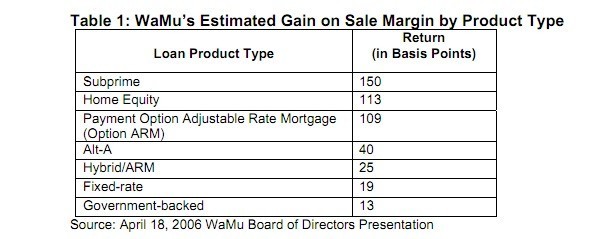

The report finds Washington Mutual continued its aggressive foray into high-risk lending because of the "gain on sale." When repackaged and sold to investment banks as securities, higher-risk loans would yield more profits for the bank.

One chart presented to the bank's board in 2006 showed that selling subprime loans could generate eight times as much profit as lower-risk, government-backed loans.

One of the largest and most aggressive issuers of subprime mortgages in the country, Washington Mutual eventually collapsed in September 2008 -- the largest bank failure in U.S. history. It was eventually purchased by J.P. Morgan Chase as part of a deal brokered by the Federal Deposit Insurance Corporation.

The FDIC last month sued Killinger and two other top executives at Washington Mutual, accusing them of reckless management of the company and seeking damages in the millions. An attorney for Killinger did not respond to an e-mail seeking comment.

The report issued by Sen. Carl Levin (D-Mich.), chairman of the subcommittee on investigations, also excoriated the Office of Thrift Supervision, the government body tasked with regulating Washington Mutual and numerous other failed lenders that aggressively pushed shoddy loans.

"Over a five-year period from 2004 to 2008, the (Office of Thrift Supervision) identified over 500 serious deficiencies at WaMu, yet failed to take action to force the bank to improve its lending operations," the report noted.

In several cases, the office impeded investigations by the backup regulator, the FDIC.

In one case, in 2006, numerous banking regulators had determined that adjustable-rate mortgages, which had upfront low monthly payments that eventually increased dramatically, were at major risk for default. Regulators issued new guidance to banks, saying they needed to consider the higher interest rates -- not the initial "teaser" rates -- before approving borrowers for loans.

But a summary of a meeting between Washington Mutual officials and regulators showed that the Office of Thrift Supervision viewed the rules as "flexible," and emphasized "should" instead of "must."

By late 2006, the FDIC discovered that Washington Mutual was not complying with the new standards, but the Office of Thrift Supervision blocked any further FDIC review, refusing to give access to loan files.

Using the delay to its advantage, the bank continued to issue billions of dollars of high-risk loans. A 2007 e-mail from Ron Cathcart, the bank's chief enterprise risk officer, implied that the delay was strategic: new requirements for income verification would cut the volume of new adjustable-rate mortgages by a third.

"When WaMu failed in 2008, it was not a case of hidden problems coming to light," the report concludes. "The bank's examiners were well aware of and had documented the bank's high risk, poor quality loans and deficient lending practices."