The big question hovering over the markets (both stocks and bonds), is whether the Federal Reserve will finally begin to raise short term interest rates at next week's FOMC meeting. Markets are uncertain, and only a few economists are saying anything. Why? Because of a tremendous (and artificial) fear of higher inflation. But inflation shouldn't be fearsome at all.

Nobelists Joseph Stiglitz and Paul Krugman say there is absolutely no reason to begin to raise the rock bottom interest rates yet. There's still too many out of work--so much so, that wages and salaries are barely rising, which is why there isn't enough economic growth to help the many still out of work.

"If the Fed focuses excessively on inflation, it worsens inequality," says Professor Stiglitz, "which, in turn, worsens overall economic performance. Wages falter during recessions; if the Fed then raises interest rates every time there is a sign of wage growth (two-thirds of product costs), workers' share will be ratcheted down, never recovering what was lost in the downturn."

And much income has been lost due to the Great Recession, as Professor Krugman and the Economic Policy Institute, a labor think tank, have pointed out for years.

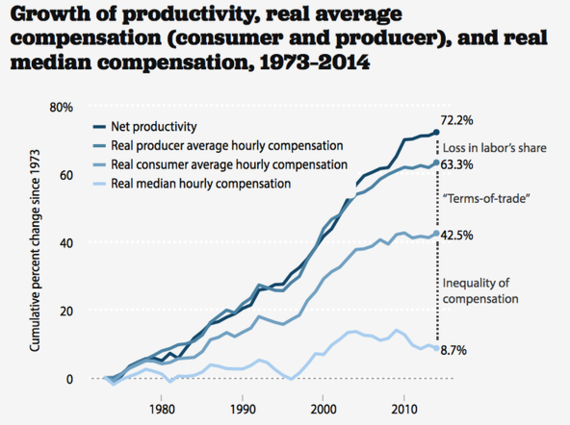

"Since 1973, hourly compensation of the vast majority of American workers has not risen in line with economy-wide productivity," say the EPI authors. "In fact, hourly compensation has almost stopped rising at all. Net productivity grew 72.2 percent between 1973 and 2014. Yet inflation-adjusted hourly compensation of the median worker rose just 8.7 percent, or 0.20 percent annually, over this same period, with essentially all of the growth occurring between 1995 and 2002."

The question is why the Fed is even discussing the possibility of higher rates with so many still out of work. This is while a record 5.8 million job openings were just reported in the Labor Department's Job Openings and Labor Turnover Survey. It is a sign of a still young labor market, and that many more jobs will be filled in the months to come.

There were 2.7 million quits in July. It's a sign of workers' willingness or ability to leave jobs, since they are considered voluntary separations initiated by the employee.. Although the number of quits has been increasing overall since the end of the recession, the number has held between 2.7 million and 2.8 million for the past 11 months.

So what is Chairperson Yellen and the Fed Governors to do? Their policies have to maximize the purchasing power of consumers that power most economic growth. If consumers can't or won't spend more, then our economy can't grow as it should.

Year-on-year wage growth is 2.2 percent, slightly higher, but inflation is falling, which is another sign that too many are out of work. The only way to increase wage growth is to allow a tighter labor market, which means keeping rates low as long as possible, because inflation is much too low for sustainable growth above the current 2 percent average.

In fact, even 4 percent inflation would be preferable as a way to boost both jobs and economic growth. But will policy makers even allow such a thing? That's the real (political) problem--the misconceptions about inflation. These days it looks like the Fed's 2 percent inflation target is just too low to boost growth.

Harlan Green © 2015

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen