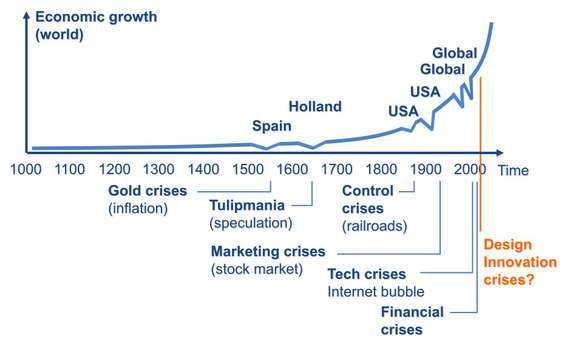

Return on investment is diminishing for all businesses and investors are rushing to Silicon Valley startups to improve their portfolios' performance in the hunt for profit. High profile successful startups, such as AirBnB, Uber and Tesla may mistakenly lead investors into believing that by applying design, innovative startups can dramatically change the odds of creating breakthrough innovations and successful businesses. What will happen when the music stops and there are just too few chairs to go around?

The business press has, in years past, touted design as the solution to most of the pains and ailments inherent in business. And yes, studies show, on average that established organizations, which understand how to integrate design at a strategic level fair seven and a half percent better than the S&P 500 index. Design research also shows that an additional twenty to thirty percent performance improvement can be achieved for established organizations. The common denominator for these studies is that the look at design is applied in established organizations and not startups.

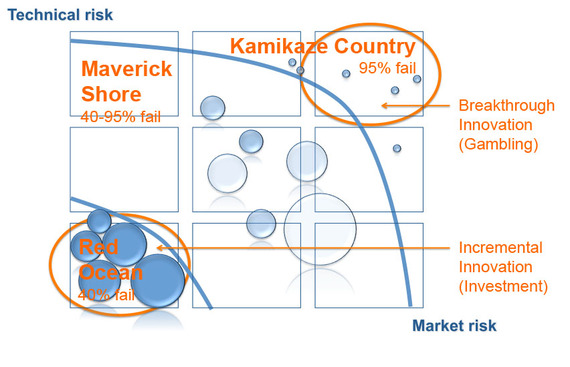

Startups continue failing at an alarming seventy to eighty percent rate for top picked opportunities, while, for average startups, the failure rate is closer to 95 percent. Simulations based on empirical data suggest that design can contribute as much as thirteen percent to an innovative startups' performance. Other factors such as the strength of the business idea, market risk and technology risk also weigh in heavily and can be difficult to predict.

By these measures, design is a valuable player, however design still does not alter the inherent laws of startup risk. Startups with exponential growth are by nature based on breakthrough innovation and this innovation type obeys the laws of gambling not investment.

Having spent the past year studying startups in Silicon Valley and San Gabriel Valley, as well as interviewing experts within new ventures and design, the sentiment is that startups, that would previously not have been considered, are now being backed at an unrealistic rate. Studies suggest that about two and a half times as many startups are funded than are actually warranted.

With unsuccessful startups, the music plays for a couple of years before they run out of financing and then it stops. That is when the sea of investors will be unpleasantly surprised to learn that their rosy perspectives have ended in bankruptcy. Design innovation will most likely become the scapegoat and investors will move on to other arenas to secure the profit they have come to expect.

Ignoring the inherent risk of innovation and overselling is never a sustainable strategy in an increasingly interconnected world. South Korea learned this when their heavy investments in design failed to deliver results from design innovation. South Korean firms face stiff price competition in consumer products from other upcoming Asian countries and are now moving on to investing in startups where history may very well repeat itself.

Art and design are, for the most part, incremental in nature. To expect these domains to be innovation leaders is to set everyone up for failure. Breakthrough innovations occur when multiple domains take on significant risk and work in concert to change the game in the long run. Quick fixes, would do well to heed the well-respected adage; "If it seems too good to be true... it probably is."