The debate about the Federal Reserve hides an issue of leadership and management that needs to be tackled.

With the approval of Sen. Ron Paul and amendments requiring increased Congressional oversight of the Federal Reserve System, we run the risk of destroying a key element of the monetary policy of the country and its influence around the world. Only Members of Congress believe that they might actually do a better job than the Fed. They seem to relish the relative impunity for their absence of leadership and their own inability to protect the United States from a catastrophic scenario.

Not everybody forgot that it took $150 billion in "bribes" to Republican and Democrat leadership to get the TARP $750 billion Act voted by the House. The inability of Congress to agree on anything has paralyzed the country. While Congress was arguing, the Federal Reserve avoided a collapse of the financial system. Let's keep the score straight. In the match between Congress and The Federal Reserve, it is clearly 0-1.

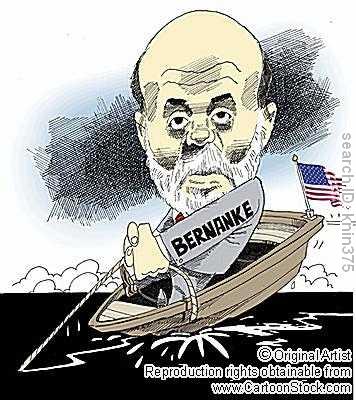

However, Ben Bernanke, for all his courage, failed to see the iceberg in front of him: in 2007 he said "the impact of the problems in the subprime markets seems likely to be contained". He denied the fact that the country was in recession waiting for the National Economic Bureau to acknowledge the recession. One year after it started. But what is more worrisome, is that in front of a $ 1,700 billion refinancing risk for commercial real estate, consumer confidence tanking and 10% unemployment, he believes that we will cut unemployment in half within two years. Responding to criticisms from foreign governments and central banks regarding financial markets, Federal Reserve Chairman Ben Bernanke said Monday, that the issue of asset market bubbles remains one of the biggest challenges facing policy makers, though he added that he does not see anything in the U.S. markets right now that concerns him.

One of the casualties of this crisis is the capacity of economists to read the signs and launch warning signals. While Ben Bernanke understands economics and numbers, he lacks the great capacity of Alan Greenspan and Paul Volcker: the ability to read the indicators and have instincts that will allow him to prevent a further crisis.

He has lost the confidence of the American people. President Obama was right to confirm him in the middle of the crisis. This was not the time to change the captain of a sinking ship. But the man is in denial: he believes in numbers, and does not see that 2010 will be dangerous to navigate. And the resonance of his recent statement to the Economic Club is a frightening reminder that he did not see the tsunami approaching.

How can we trust that he will be able to anticipate future adversities? Should the country's current "crisis manager" become the next Fed President? I think not.

It seems to me that we need someone with not only a great intellect, but someone with sensitivity to the evolution of the market, as well as the foresight to predict what will rock the ship in the coming months and years.

We cannot afford to employ a captain who did not see the approaching iceberg and who lost the confidence of his crew to protect the ship from the next one.