The received wisdom these days is that the West is in rapid decline, and China is on an upward trajectory that cannot be stopped. Sooner or later the pundits say, the two lines will cross-- perhaps explosively-- and China will rule the world. The latest evidence? Klaus Regling heading to Beijing on Friday to beg for Chinese financial aid to rescue Europe. It is certainly a long way from the foreign treaty ports and other indignities that China suffered at European hands in the last century... I wonder if there is a Chinese word for schadenfreude?

I might have contributed modestly to the momentum theory of China's ascendancy myself with the 2003 article that David Hale and I wrote for Foreign Affairs, China Takes Off. To say that China is rising is one thing however, because that is undoubtedly true. To say that China will rule the world is quite another.

An amazing number of Americans who were polled recently incorrectly believe that China's economy is already bigger than the US. The view from inside China is somewhat different. As any thoughtful person there will attest, China faces a slew of obstacles at this stage of its development. China might be a rich state, but its people remain poor. China may become the world's largest economy in 2016 according to optimistic estimates by the IMF, but that simply means that total output will be larger than in the US. A country with 1.3 billion people should have an economy larger than one with .3 billion in absolute numbers: China's population is more than four times larger. If both economies were exactly the same size, China's GDP per capita would be just 25% compared to the US.

What this means is that in spite of the overall size of its economy, the standard of living in China is correspondingly lower. Just one example to put this into perspective: only 20% of Chinese people have flush toilets. The inescapable fact is that a world in which Chinese consume at the same rate as Americans is a world that cannot exist, based upon available resources of food, water, energy, and other commodities and products such as cars. It would require by some estimates four plant Earths. There is a natural limit to Chinese consumption simply because there are so many Chinese people. This might be unfair, but it means that the great majority of Chinese will not be able to enjoy the kind of life we live here in the US absent exponential and unforeseen technological progress.

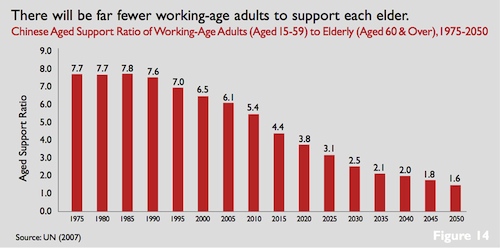

Demographics play a crucial role in terms of limiting Chinese growth and economic prosperity. China's population, similarly to Japan, is getting older. The difference is that the Chinese are not going to be as rich as the Japanese by the time that much of their population is over the age of 65. By 2040, assuming current demographic trends continue, there will be about 400 million Chinese elderly with fewer descendants to take care of them than in previous generations. According to a report by CSIS, The Graying of the Middle Kingdom instead of the current ratio of 6:1 working adults to elder dependents, by the middle of this century there will only be about 1.6 working adults for each elder. Due to the lack of job-related and government pension funding the end result will be that China's savings, upon which her wealth has been built, will erode. China faces a steady decline in its workforce beginning mid this decade, thanks to the One Child Policy.

The elderly are also major consumers of health care services. The United States is the richest nation on earth, and has positive population growth, but we are still worried about being able to take care of our baby boomers in the future. In today's China, healthcare is at a premium, and many people in the countryside cannot afford any medical treatment-- full stop.

According to a recent article in Foreign Affairs by Yanzhong Huang, The Sick Man of Asia, China's Health Crisis in 2006 80% of China's health care expenditures were funneled into the treatment of only 8.5 million government officials. Another amazing statistic Huang cites: more than 73% of Chinese hospitals have reported violent incidents between patients and healthcare professionals. Why? Because feelings run high when you are told that your child, your parent or your spouse cannot be given treatment because you cannot pay for it. China is worried about getting both old and sick: by 2040, more Chinese will be suffering from Alzheimer's than the total populations of all the developed nations combined.

Health care is not the only area of concern. The Chinese government is aware that there is growing resentment of income inequality, the result of the introduction of capitalism and the wholesale abandonment of its social safety net. When I first went to China in 1979, the so-called Gini coefficient, the measurement of income inequality, was low. China was a truly socialist country and all services including housing were provided by the state. China in 2011, nominally and in fact politically still a communist country, has greater income inequality than the US.

Someday China's 99% could be a truly potent force. China's leaders are worried about organized protests. There is no Twitter in China, as I recently confirmed with the co-founder of Twitter, Biz Stone. Facebook does not function, and the Internet and all online news is censored. Chinese citizens will increasingly face an asymmetric information gap as they struggle to compete with other large developing countries such as India, which allow the free flow of information. This is not an environment in which innovation can flourish. Try to imagine a Chinese Steve Jobs--almost all of the new companies in China today are derivative of US products, services, and business models.

Examples of the limits of technological progress in the face of suppression of information can be seen in recent accidents involving China's showcase technology. The bullet train tragedy, the grounding of the new Airbus made in China, and similar events add up to an enormous glitch factor as China attempts to step up the technology ladder to more complex systems. Overheard comment--an inspector on the Shanghai's vaunted subway system will not allow his family to use their trains. Whenever there is an atmosphere of fear, bad news does not get reported up the command chain.

Other countries are increasingly less willing to share their technology with China for a variety of reasons. Some businesspeople have had bad experiences, either in terms of political pressure (Google) or more commonly, theft of intellectual property. Lack of protection by China's legal system is cited as the number one structural impediment to foreign companies doing business in China. This all goes back to the ideal of creating an atmosphere in which ideas can flourish and R&D spending is rewarded through the stock market and other vehicles, a process that is not taking place in China today.

Small business, the cradle of job creation everywhere, is at a lending standstill in China. Most small and medium size businesses are forced to go to the black or "informal" lending markets for funding, with interest rates of 20, 30 and 40%. Chinese banks are equipped to funnel loans to the large state-owned businesses, but they do not have credit analysts who can determine whether or not a business should be given a loan on its own merits. The languishing stock market is still dominated by behemoth state-owned enterprises, so when startups need capital, they often turn to foreign investors. In spite of the glut of savings within China's banking system, all of China's major Internet firms raised funds in US stock markets--Sina, Sohu, Alibaba. Lack of access to capital has also resulted in the loss of thousands of Chinese engineers and entrepreneurs who decided to come to the US to start their businesses, to the inestimable gain of Silicon Valley.

Another common misperception is that China will overcome the US militarily. First of all, China has no major allies, with the possible exception of Russia, which clearly seeks to protect its own interests first and foremost. The US on the other hand has firm global allies, military bases worldwide, and a navy that girdles the earth. Secondly, in today's world, warfare is all about technology, and in spite of its successes with rockets and satellites, China is still handicapped in this area. Finally, there is the question of political will. China will fight to protect its interests in Taiwan and in Tibet. But other than that, North Korea has proved to be a major albatross, and there is another strong power in the region, Japan, which will do everything it can to check China's military ascendency.

All of this is not to say that China isn't the greatest success story of our generation. It is a land and a people I love dearly, a civilization whose history and art are unparalleled in many respects. But there is no predetermined place for China to regain on the world stage--history is that simple. When you next read about the "end of America" or China's "inevitable" domination, put on your skeptical spectacles. In spite of the visible, flashy wealth of its modern coastal cities, China is still very much a developing economy on the brink of major changes. Its current system of centralized non-democratic government might be perfect for implementing unpopular choices such as joining the WTO, a decision that was estimated to cost 50 million jobs at the time. The question is whether China has been able to use its wealth it has gained since joining the WTO to create institutions that can bring longer-term stability.

As China is transitioning to become a full member of the world community from which it was entirely separated just forty years ago, we have perhaps seen the end of Chinese rather than American exceptionalism. The characteristics that allowed China to make enormous progress to date are not necessarily the qualities that will be needed to create productive global integration going forward. China is already our greatest commercial partner, and the US should do everything it can to encourage China's engagement, including eschewing trade barriers of all kinds. Overly optimistic misinformation about the realities China faces can lead to poor decision-making by our own government officials. The bottom line is that we should not fear a strong China. Rather, we should fear a weak China.

What are the steps China should take? It should implement a path to full convertibility of its currency and open capital accounts, end financial repression, promote income equality and access to social services, allow the free flow of capital and information across and within its borders, promote freedom of expression-- all these changes and more need to be executed carefully and with all deliberate speed. With a leadership transition looming, the Chinese ship of state now requires a captain who recognizes that China's future depends on integration rather than exceptionalism.

I believe that being China's leader at this time in history just might be the toughest job on earth.

This post originally appeared at the Yale Books blog.