When it comes to unlocking solar for the world's poor it's all about the money.

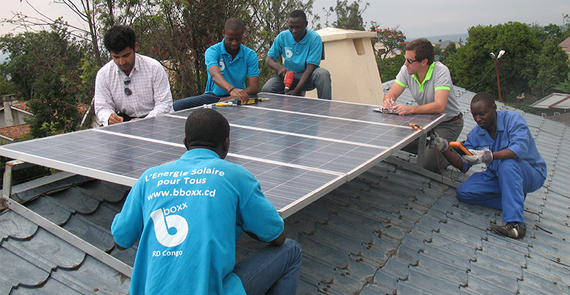

That's why this week's announcement that beyond the grid solar firm BBOXX will lead the industry's first ever securitization is really big news. Because despite leveraging business and financial model innovation to unlock the world's most sophisticated cleantech for the world's poorest populations scaleable investment has been painstakingly slow to materialize. That's because the same enterprises face a trifecta of risk that has restricted access to the money they need to scale and end energy poverty once and for all. They are serving poor customers, in risky emerging markets, with new technologies. That is simply too much for most mainstream investors to swallow, which is prolonging the wait for a billion plus people to access clean affordable power.

Show Me the Data

In order to solve this seemingly intractable problem BBOXX, and other companies like them, need to prove their case. Accurate information (i.e. credit analytics) demonstrates to these risk-averse investors that not only will these populations pay investors back but they will do so in a predictable fashion that will generate financial returns for investors. Which means solving one of the worlds biggest challenges - delivering energy access for all - relies on something fairly simple: data.

Data turns out to be something this industry is particularly well-suited to provide. Unlike many energy providers in the developed world, those in emerging markets have based their business models on sophisticated technologies that produce reams and reams of data. For instance, many of the leading companies providing solar powered electricity to off grid households and businesses rely on sophisticated pay-as-you-go technology that leverages mobile money and communications platforms to deploy solar for the poor. Both of those platforms generate enormous amounts of data which if properly compiled and analyzed can paint exactly the picture financial institutions need to see in order to invest.

Compare that to the United States where we are still struggling to roll out and utilize basic technologies like smart meters. That coupled with much longer payback periods and operational lifetimes makes it easy to see the comparable advantage these companies operating in frontier markets enjoy. Indeed, we only recently saw the first securitization of rooftop solar in the US in the past couple of years.

Beyond the Grid Solar's First Securitization?

At its most basic a securitization is a way for a company to bring customer installment payments forward in time by selling notes to investors backed by customer payment obligations. For instance, if I owe 20 years of monthly payments on my solar home system to Solar City, a securitization allows Solar CIty to sell that obligation to an investor for cash today. This ability to capture customer cash flows today is incredibly important because having that cash on hand allows the company to turn around and invest in new customers thereby expanding solar's benefits to more and more people (as well as the company's own bottom line). That cycle, and the cheaper financing it brings, could do wonders to scale solar beyond the grid.

Data De Risks Lending

In announcing the first securitization of off grid solar systems sold to residential and small business customers, industry pioneer BBOXX has utilized the nearly 12 years worth of data it collects every single day to structure asset-backed notes it can sell to investors. The notes - named Distributed Energy Asset Receivables, or DEARs - represent a bundle of customer contracts, with an average contract present value of $300. BBOXX transfers this $300 contract to a special purpose vehicle (SPV) created to own the contracts and in return collects a payment of $210. If BBOXX's installed cost per system is less than $210, BBOXX will have immediately recovered all of its costs and some of its profit.

The DEARs pool of securitized assets consists of 2,400 customers who have certain traits that make the likelihood of default low. These traits are known to BBOXX based on repayment history BBOXX has already collected. Going forward BBOXX will be able to apply ever more sophisticated data analysis to de-risk its pools of securitized customer solar assets. As a result, it will be able to more accurately forecast customer repayment characteristics. This will attract more investors and also allow BBOXX to sell DEARs notes with smaller amounts of excess coverage (or overcollateralization) to protect investors from nonpayment risk..

The DEARs structure has convinced Dutch-based investor Oikocredit to buy the first issuance for a total value of 52 million Kenyan Shillings. BBOXX plans a second placement for March of 2016 for 250 million Kenyan Shillings (~$2.4 Million USD). The second DEARs transaction will be rated by a Kenyan registered credit rating agency. BBOXX, Oikocredit and financial advisor Persistent Energy Capital created this structure as a scalable funding tool for BBOXX. BBOXX expects to grow the issuance of DEARs notes substantially and is aiming to finance the equivalent of $16 million in 2016 in dollars and local African currencies.

"This is the only financial structure that can scale to billions" Mansoor Hamayun, CEO of BBOXX said. "The fact that we can securitize the credit risk of the unbanked and, very soon, get rated, has us very excited. We now have a methodology to bring solar electricity to off grid customers at a larger scale" says Mansoor. This financial inclusion that data and the DEARs structure make possible is what makes distributed solar energy an incredibly powerful development tool, one many in the financial inclusion community are only now beginning to recognize.

This transaction represents an important step toward financing off grid energy access companies in the mainstream capital markets. Chris Aidun, CEO of financial advisor Persistent Energy Capital, which structured and placed the DEARs notes, said "We are thrilled to have helped put this tool of modern global markets to work to finance off grid solar energy companies. We believe that DEARs will bring in new global and local institutional investors as DEARs note financiers and that this propel the growth of these companies to reach the millions of customers who want affordable clean energy that can bring them the modern services of lights, TVs, radios, refrigerators and much, much more."

Ultimately, this transaction represents financial innovation that happened faster than anyone could have ever predicted. It's no wonder industry leaders Solar City, DBL and others have woken up to the opportunity in this space. For those who haven't, you better catch this train because it's moving fast.