By Jeanine Prezioso

NEW YORK, Oct 10 (Reuters) - Oil prices jumped more than $2 to their highest in a month on Thursday on growing hope for a deal to extend funding of the U.S. government and concerns over supplies from Libya and the Middle East.

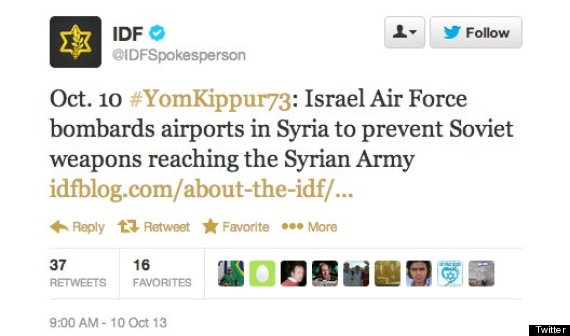

Oil rose initially on news that Libyan Prime Minister Ali Zeidan was captured and held for several hours by former rebel militia. Later in the morning, a Twitter post commemorating the Yom Kippur war spooked traders, who initially mistook it as news of a serious escalation in Middle East violence.

Brent crude oil gained steadily across the session, rising by $2.66 to $111.72 as of 1:11 p.m. EDT (1711 GMT). U.S. crude was up $1.81 at $103.42. Both contracts headed toward their biggest gains in three weeks.

U.S. House of Representatives Republicans plan to offer President Barack Obama a short-term increase in the federal debt limit if he will agree to negotiate with Republicans on matters including funding to reopen the government, which has remained in partial shutdown since last week.

U.S. stock markets climbed by nearly 2 percent on hopes of ending the U.S. government budget stalemate, adding support to the oil market.

Oil traders were also on alert for signs of further disruption in supplies from the Middle East and Africa.

Libya's oil output has recently recovered to 700,000 barrels per day, after falling at mid-year to its lowest since the country's 2011 civil war after a combination of strikes, militias and political activists blocked the majority of Libya's oilfields and ports in late July.

A Twitter post or tweet by the Israel Defense Forces recounting an event 40 years ago during the Yom Kippur War added to the market's jittery mood. The post - which read "Oct. 10 #YomKippur73: Israel Air Force bombards airports in Syria to prevent Soviet weapons reaching the Syrian Army" - was misread by some as announcing a new attack.

The spread between global benchmark Brent and U.S. oil had widened earlier in the session as the price of Brent, which is more sensitive to geopolitical events, rose, said Gene McGillian, analyst with Tradition Energy in Stamford, Connecticut.

"You're not going to have any problems with oil supply in the U.S.," he said. "We are going to continue to pump by multi-decade highs."

The spread had widened to as much as $8.95 per barrel