NEW YORK, Jan 5 (Reuters) - Energy sector stocks led a broad selloff on Wall Street on Monday as crude prices fell to fresh 5-1/2 year lows and a strong dollar also weighed on other commodities.

Crude oil futures prices dropped to their lowest since May 2009 amid a global supply glut and lackluster demand. Russia's oil output hit a post-Soviet high last year, and Iraq's oil exports in December were highest since 1980.

U.S. crude dipped below $50 a barrel for the first time since April 2009 and Brent fell 6 percent.

The broad selloff in stocks is a result of traders knowing where they don't want to be invested before identifying the next buying opportunity, according to Gordon Charlop, a managing director at Rosenblatt Securities in New York.

"There is a lot to digest right now," he said regarding the side effects of the trampling of oil prices.

Aside from the positive effect it has on consumers, traders are figuring out where the plunge in energy could be negative for other sectors of the market.

The strength in the U.S. currency is putting even more pressure on dollar-denominated commodities. A measure of the greenback against a basket of major currencies hit its highest since December 2005.

"Multinationals will have their earnings decreased if they aren't fully hedged," said Rick Meckler, president of LibertyView Capital Management in Jersey City.

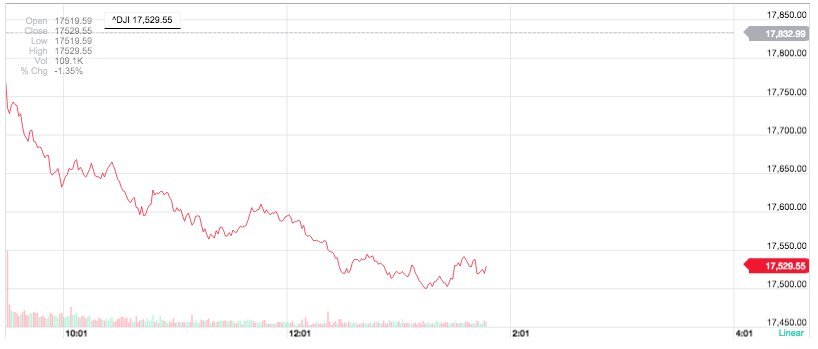

At 1:11PM the Dow Jones industrial average fell 312.54 points, or 1.75 percent, to 17,520.45, the S&P 500 lost 35.76 points, or 1.74 percent, to 2,022.44 and the Nasdaq Composite dropped 66.01 points, or 1.4 percent, to 4,660.80.

The S&P 500 energy sector was down 4.25 percent, on track for its largest daily percentage decline since November 28. It fell almost 20 percent in the second half of last year. The health sector, the S&P's best performer on Monday was down 0.47 percent.

The S&P's worst performers were Denbury Resources Inc which fell 10 percent, and Noble Energy, down 9.8 percent in afternoon trade.

One bright spot was Gilead Sciences Inc. Shares rose 2.4 percent after CNBC reported CVS Health Corp, one of the largest U.S. managers of drug benefits, will give Gilead's hepatitis C treatment preferred status and cover a competing treatment from AbbVie Inc only as an exception. AbbVie shares lost 2.3 percent.

Declining issues outnumbered advancing ones on the NYSE 2,411 to 659, for a 3.66-to-1 ratio; on the Nasdaq, 1,784 issues fell and 926 advanced, for a 1.93-to-1 ratio.

The S&P 500 was posting 5 new 52-week highs and 6 new lows; the Nasdaq Composite was recording 43 new highs and 25 new lows. (Additional reporting by Rodrigo Campos and Chuck Mikolajczak; editing by Bernadette Baum and Nick Zieminski)