To paraphrase Winston Churchill, "[capitalism] is the worst form of [economics] except all those other forms that have been tried from time to time."

I subscribe to capitalism with the same sense of faith and irony. As I mentioned in my previous blog post, it is compelling that the financial services industry should be such an incredible example of capitalism's failure. Of course, I do not believe capitalism itself has failed. It hasn't even had a chance to succeed. Bribery (under the guise of campaign contributions), regulatory capture and lobbyist influence -- these noxious forces have corrupted our political and economic system.

Markets are the bedrock of capitalism, theoretically enabling efficient allocation of resources and price discovery. In reality, they have become simultaneously beholden to the manipulation of the Federal Reserve and a veritable casino of poorly regulated (or completely unregulated) gamblers and speculators, with incredible brain power and unprecedented computational resources. While markets yearn to be free, we have long accepted that regulations are necessary to curb market excess and ensure fairness. Matt Taibbi argues: "In a society governed passively by free markets and free elections, organized greed always defeats disorganized democracy."

As such, unregulated markets spin out of control, much in the same way as poorly regulated markets do. We have too much of both today, and it has imperiled our global economic system.

While High-Frequency Trading has (justifiably) been a favorite target, it is only symptomatic of a much larger, more fundamental problem. Other evidence for this include:

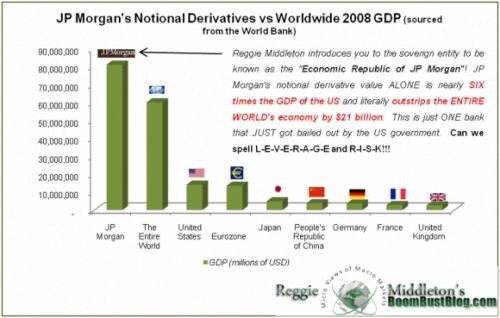

- Too Big To Fail Institutions ("TBTF") and the Repeal of Glass-Steagall: TBTF would not exist in a truly capitalist system. They are created through regulatory capture and government subsidies. And yet, our government not only subsidizes these "Systemically Dangerous Institutions" -- as Bill Black so eloquently labeled them -- it has even forced smaller institutions to join forces to become far more systemically dangerous (e.g. Bank of America + Merrill Lynch; JP Morgan + Bear Stearns).

- One cannot meaningfully discuss TBTF without recognizing its relationship to the Glass-Steagall Act. The Glass-Steagall Act mandated a separation between commercial and investment banks; essentially, Congress tried to protect the financial services industry from the weight of its own heft, and this worked for nearly 70 years. For example, as Luigi Zingales points out in a recent Financial Times op-ed, the 1987 stock market crash did not impact the economy, because commercial banks were unaffected. Likewise, Zingales notes, "securities markets helped alleviate the credit crunch (of the early 90s) because they were unaffected by the banking crisis."

- The Financial Crisis of 2008 offered a clear illustration of what happens when investment and commercial banks commingle. Quite simply, TBTF did just that -- the private sector failed, and the public has had to pay the price. The mess has compounded daily since then, with no end in sight.

- A dramatic shift took place starting in the 1990s; Alan Greenspan dropped the Fed Funds Rate and kept it low for an extended period of time. The financial services industry, which had never comprised more than 1.7 percent of GDP (and had averaged just 1.2 percent) from 1929 - 1988 suddenly started growing to peak at an unsustainable 3.3 percent of GDP in 2005.

- New York Times writer Floyd Norris blames excessive risk-taking and an unregulated derivatives market for this concentrated spike in the industry's share of GDP. In this connection, it is hardly a wonder that our outsized financial services industry has pushed society away from fair, orderly markets and into a spiraling series of bubbles and crises.

Of course, this post is really just a tip-of-the-iceberg treatment of a topic that has been covered extensively. Unfortunately, movements to reduce partisanship and the influence of money on the financial services system are met with tremendous resources -- political, financial and media -- that also seek to preserve the status quo. I am not suggesting that we seek an alternative to capitalism, as we've seen that other economic systems fare as badly or worse (see: USSR, Europe). But we do need to refom our government and regulators, starting with the two-party duopoly and the campaign finance system. These dramatic reforms might give capitalism a chance to function.

In my next blog post, I'd like to delve deeper into some proposed reforms for financial services in our continuing search to create a more just and equitable economic system. As I've mentioned, I believe economic and political reforms must go hand-in-hand. It does us no good to attack the squid when it's feasting on an unending food supply of corruption that will just spawn another in its place.