The debate on the economic woes of Finland continues to revolve around the question whether or not the euro is the blame (see J. Cohen-Setton for an excellent summary). Although debate continues to be that of high quality, there is very little evidence to support the arguments made in it. This is because we do not know what would have happened to the Finnish economy if she would have not joined the euro. Or do we?

Four years ago, yours truly, Dr. Henri Nyberg and Dr. Ulla Lehmijoki came up with an idea to simulate the development of Finland's export sector under the assumption that Finland would have never joined the euro. The study was published in our firm's webpage in March 2012. What we found was that the exports of Finland would have been some 15 percentage points higher in 2011, if Finland would have had its own (floating) currency.

How did we came up with this number? First, we needed to simulate the foreign value of the Finnish currency, the markka. Our simulation was based on four assumptions:

1. Everything that has happened in the world economy after 1998 would have happened exactly in the same way even though Finland would not have been a member of the eurozone.2. All the current members of the euro zone would have joined euro even though Finland would have not.3. The economic development of Finland would have been the same until the end of 1998 whether she had joined the euro or not.4. The Bank of Finland (BOF) would have adopted essentially the same monetary policy as the Riksbanken, i.e., the central bank of Sweden.

The simulation was based on the exchange rate between the currency of Sweden, the krona, and the euro. History shows that there is a long-run equilibrium relation between the markka and the krona. This makes krona an excellent basis for an estimation of the theoretical value of the markka. We also assumed that the interest rate set by the BOF would have followed that of the Riksbanken, but with a small stochastic component that would have kept the interest rates somewhat higher in Finland.

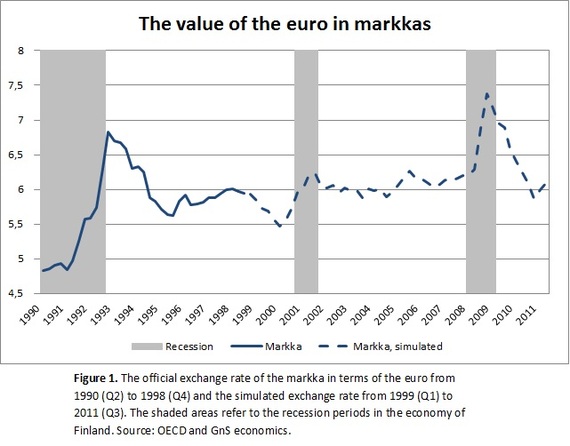

Using the simulated exchange rate between the markka and the krona, and taking the realized exchange rate between the krona and the euro into account from 1999 onwards, we constructed an exchange rate between the markka and the euro. Figure 1 presents the theoretical (simulated) value of the markka with the euro.

Figure 1 gives the approximate value of how many markkas one should pay for one euro; the higher the value in the Figure, the lower the external value of the markka. According to the simulation, markka would have appreciated immediately after the shift to euro until the value of 1€ = 5.50 markkas. The lowest value of markka would have realized during the financial crisis of 2007-2009, more precisely at the beginning of 2009. At this point one euro would have cost around 7.40 markkas, implying that markka would have depreciated by around 20 percent during the crisis.

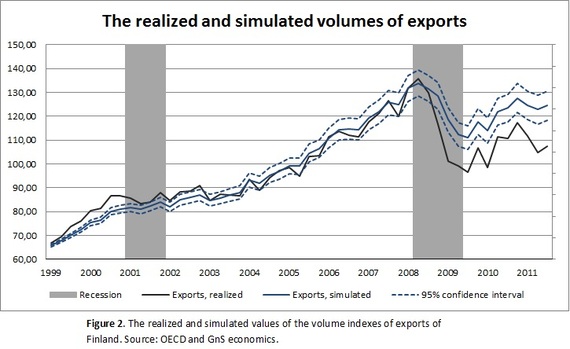

The simulation model for the export of Finland consisted on the history of Finland's exports during the euro membership, on the partly realized and theoretical exchange rate between euro and markka, as well as on the activity in the world economy. In particular, our model depended on the GDP growth rates of the U.S. and the eurozone. As expected, a depreciation of the (simulated) markka-euro exchange rate and increasing economic activity in the world economy increased the export of Finland, and vice versa in the theoretical model behind our simulations. Figure 2 presents the simulated value of Finland's exports under the markka.

Figure 2 shows two things. First, exports in Finland would have been around 6 % smaller during the IT-bubble if Finland had not joined the euro. However, if Finland had not been a member of the eurozone, its exports would have been more stable already during the recession in 2001 and they would have risen considerably after the financial crisis of 2007-2009. As seen from Figure 1, markka would have experienced a considerable depreciation during this crisis and, as a consequence, the export sector would have performed better. The values of this sector were some 15 % larger in our simulations than what was realized in the end of 2011. Therefore, in terms of exports, by keeping markka Finland would have experienced a faster recovery from the financial crisis. What is not mentioned in the report is that we used a restricted simulation model for the analysis and if we would have used an unrestricted model, it would have shown even a bigger increase in the volume of exports.

Several reservations naturally need to be attached to our results. Most importantly, they are just theoretical simulations from a state of the world that was never realized. Still, they are based on rigorous theoretical and statistical analyses. In this retrospect, their results are considerably more reliable than the, usually sophisticated, opinions made and the selective use of data often exercised in the debate concerning the economic situation of Finland.

Our counterfactual analysis of the Finnish export sector thus implies that the majority of Finland's economic malaise has not been the fault of (e.g.) the fall of the Nokia ltd., Finland's rigid labor market or the collapse of the paper industry, but the euro. They naturally had a role in the non-existent recovery of Finland after the financial crisis, but these structural issues became a serious burden to the economy only because Finland uses the euro.

Although the Finnish economy is in a dire need of a restructuring, the main blame on our economic woes should be placed where it belongs, namely on the euro membership.