There's a "secret" just for entrepreneurs that top financial consultants are eager to share: Moving overseas can, in somecases, save you a bundle on your small business.

I wrote about it before, for some entrepreneurs and small business taking advantage of offshore opportunities is a sensible way to diversify investment channels. There's a "foreign tax exemption" which makes it legal for you to pay zero state tax and very little federal tax (alternatively, consider starting a business in a state with no income taxes). You will, of course, be "doubly taxed" for both Medicare and Social Security taxes--just like you would in the US--since you're both the employer and the employee.

There's no getting around Medicare and Social Security taxes as an entrepreneur, but why pay more in taxes than necessary?

Each year, the Internal Revenue Service (IRS) has the ability to change the cap on foreign tax exemption, but for the most part it stays pretty steady. In 2014, the cap was $94,500. That's a pretty big chunk to go almost totally federal tax-free. You can of course go above that cap, but at that point you'll start being taxed. The only rule is that you have to be physically in your "adopted country" and outside the U.S. 330 days of the year--so basically you'll be moving abroad.

Travel Abroad? Try Living Abroad.

There are some instances where entrepreneurs can't swing this. Maybe you have family commitments, such as taking care of an aging parent, and are committed to doing it yourself or seeing them regularly. Maybe your partner has a lucrative, fulfilling career that's location-based. However, if you're one of the lucky few who can move overseas, pack that bathing suit and start perusing beach houses. As a bonus, cost of living in many foreign countries is much cheaper than the U.S., and there are increasingly more areas that are ex-pat friendly.

However, it's not all glitter and unicorns when moving (and starting a business) overseas. Banking can be difficult, especially when your clients are back in the U.S., making payments in dollars (and to American financial institutions), or if you otherwise need to keep an American bank account--like to pay for something like student loans.

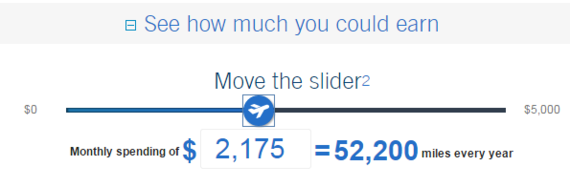

Not all institutions are created equally, but there are a few U.S. accounts that greatly complement ex-pats and businesses overseas. The benefits? Think no foreign transaction fees and earning great flyer miles with certain credit cards.

Here are a few to consider:

1. Capital One Venture Card

Everyone wants something different with credit card perks, but for ex-pats it just makes sense to choose a travel-focused program. This company's "Venture" card gives you double miles for travel, including airfare, hotels and rental cars. You can also use the points to get a paper check, "erase" travel-related expenses from your card, and their online travel booking site is intuitive and user-friendly.

2. Schwab Investor Checking

This is one of the more widely-praised checking accounts. There's no minimum balance, no foreign transaction fees, and you also earn interest. It's one of the best checking accounts for ex-pats, and of course you can set up direct deposit or PayPal from certain clients.

3. Bank Americard Travel Rewards Credit Card

Also featuring no annual fee, zero foreign transaction fees, and even coming EMV-enabled, this is another killer credit card for travelers. You get 1.5 points for every dollar, which is less than the Venture Card--but you can use them for cruises, baggage fees, rental cars and luxury vacation packages.

4. Venmo

Okay, this isn't a credit card or bank account, but it's a fantastic way to send and receive money for free without those pesky PayPal fees. However, it's just for American accounts, but it's still relevant for ex-pats. There's a good chance your clients will be US-based (higher wages) and you want to be able to receive money without being dinged for it.

Moving abroad is a great way to start a business while enjoying no state taxes, minimal federal taxes, and a lower cost of living. Just make sure you abide by tax rules in your adopted country, which vary greatly but are often very generous to ex-pats.