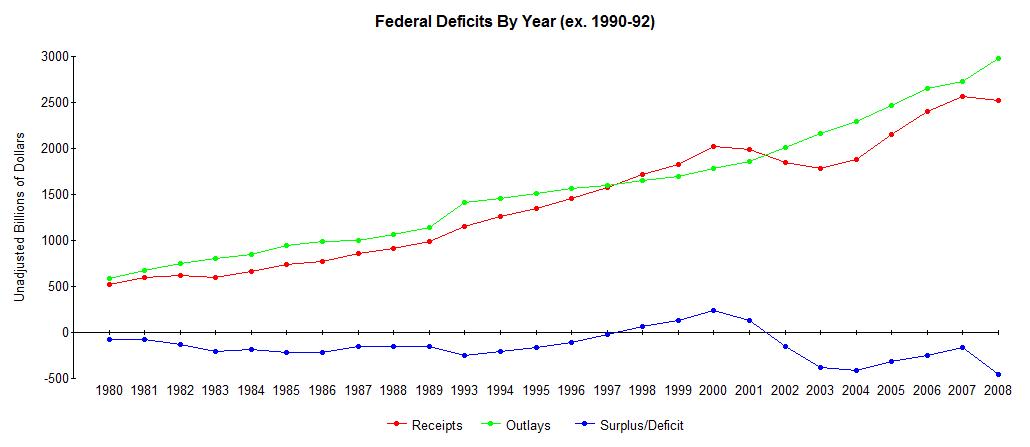

The raw numbers are enough tell an inconvenient tale of this mainstay of conservative politics, that lowering taxes spurs the economy and so increases government revenue based in economic growth. The chart (below) of federal budget, by year, from the Office of Management and Budget history data (page 27), illustrates federal revenues and deficit over 28 years. 1990-1992, the "Read My Lips" years, are omitted from the chart. The deficit gap of 1993 was attributable to a recession and the Gulf War (Gulf War I).

Notice an immediate decline in federal receipts in 1982 as the first effects of Reagan's tax cutting Economic Recovery Tax Act of 1981 took effect. This was coincident with a recession, so the precipitous drop in revenues might be partially attributable to recession. Thereafter, though, receipts tracked the economic recovery and then an economy growing at an unexceptional rate that never overtook outlays during the Reagan administration. Outlays grew during that time but not at an exceptional rate from the overall trend of government spending relative to growth in economic output. The debt grew at an exceptional rate because of the shortfall of revenues created by the tax cuts.

According to Bruce Bartlett's summary, over the 7 years post income tax cutting, Reagan presided over implementing incremental tax increases wiping out half of the initial $264 billion in tax cuts with $132 billion in tax increases. This seemed to begin to close the gap created by the initial Reagan tax cuts by 1989.

Reagan didn't reduce American's net tax burden but just redistributed it away from income taxes on the rich and corporations and onto working people and small investment concerns, and piled the remainder on the debt. The Tax Equity and Fiscal Responsibility Act of 1982 (increased the federal unemployment tax), passed over Reagan's veto, Social Security Amendments of 1983 (raised the exclusion limit for wages subject to Social Security taxes) and Deficit Reduction Act of 1984 (reduced the benefits from income averaging) being the primary tax cut erasers. In the end, regressive taxes went up under Reagan but with some attention to fine tuning investment activity.

Reagan disproved the concept that tax cuts increase revenues of government. Only the raising of taxes closed the deficit gap. Yet the question still remained open for conservatives, if not sensibly, burdened as they are with a misconception about how economies are driven.

Bush 43 could be the final baking of the tax cut growing revenues cake. The Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) and the Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA) resulted in an immediate and severe reduction in receipts while the trend in outlays accelerated. The EGTRRA cuts were coincident with the Dot Com bust recession of 2001-02, so part of the revenues lost can be attributable to recession.

As the chart shows, the tax receipts grew at a respectable rate after 2003 as the economy did in fact grow in the financial sector and housing during the years 2004-07 (health care too, but that's a different story). The reason for that growth is almost entirely attributable to aggressive Federal Reserve easing policy even post 2001-02 recession, which encouraged borrowing and fueled stock market and housing investment bubbles. That easing policy lasted until 2005 when it was finally gradually reversed, peaking with a Fed Funds Rate of about 4.5% in 2007-08 The result of that modest increase in Funds Rate was that the economy stalled and then retracted, having been powered by effectively negative interest easy credit.

Analysis of the effects of specific economic factors is, as always, difficult because few policy changes happen in isolation from other factors. Both the Reagan tax cuts and the Bush 43 tax cuts were undertaken during a recession and accompanied by aggressive Fed easing. Fed easing is the primary tool by which it can stimulate economic growth and reverse a recession. So any speculative effects of Bush's tax cuts is at least substantially overshadowed by the proven simulative effect of Fed easing and are then indistinguishable. Note that Fed easing is not capable of simulative effect in a depression. It wasn't during the Great Depression and is not now. Lenders hunker down in a severe recession and lending is curtailed out of fear that collateral will depreciate and that borrowers are more likely to default than when economies are growing. It's sensible, but makes the Fed useless at times like this.

So the largish tax cuts of Bush and the partially reversed tax cuts of Reagan had no discernable effect in raising federal revenues when considered with other factors, and neither seems to have stimulated the economy.

If existing data is not convincing because the effect of tax cuts is seemingly so miniscule, proving the converse is clearly possible. In the middle, between Reagan and Bush 43, Clinton raised taxes. The budget was balanced and surpluses were created with modest increases in tax levies, all while economic growth was sustained.

Under all three of Reagan, Clinton and Bush 43, federal revenues grew. Under Reagan revenues increased, unadjusted for inflation 33%, Clinton 43% and Bush 43 21%. Economic growth for the respective administrations was 25% (with Fed easing), 26% (with no Fed easing) and 15% (with massive Fed easing), all adjusted for inflation. It's clear that raising taxes works and it seems the effect of tax cuts is non existent or so paltry on economies or government revenues that no positive effect is evident.

Why tax cuts don't work to raise revenues is inherent to capitalism. The ostensible purpose of capitalism is to create concentrations of wealth that can by used for investment. Tax cuts might be requisite to growth if the U.S. had a paucity of accumulated private capital, but since more capital is now laying around fallow than can be made use of by even the global economy, cutting taxes on the wealthy and corporations serves only to make the wealthy richer and to fudge corporate P/E ratios without them actually doing anything creative or productive. So tax cuts just go into reserves of capital that never get used. $1.2 trillion is parked in off shore tax havens doing nothing at all but avoiding taxation.

Given the documented failures of the Reagan/Bush tax cuts to achieve anything like what was promised, conservatives now rely on a modification of tax cut mythology, arguing that if spending can be cut enough then lower taxes can be justified. This is a more truthful and more traditional approach to their agenda of cutting taxes, but is still couched in mythology. Why would you cut spending and taxes at all?

Next Conservative Myth Busting: Cutting Government Spending Creates Jobs