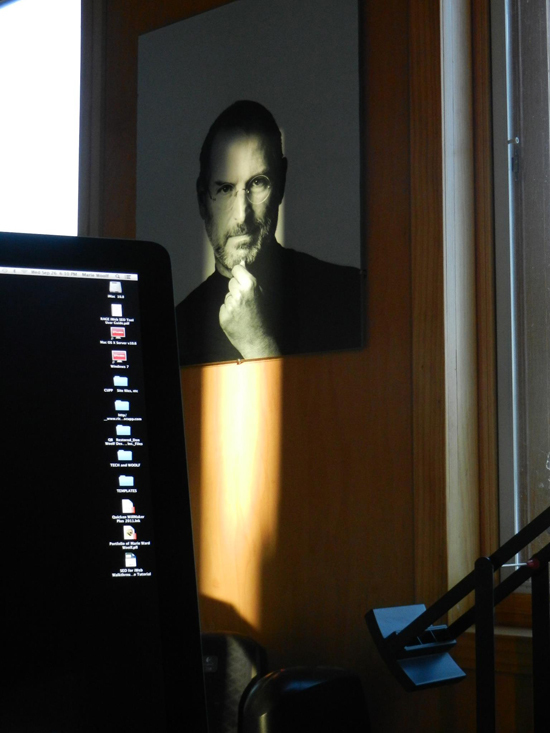

"Oh wow. Oh wow. Oh wow." Steve Jobs' last words are mysterious to agnostic types but though, as a person of imagination, I believe I absolutely get his meaning it turns out Jobs' legendary vision might have also applied to the mortal hereafter in that how the interminable recession, at his point of departure, might inevitably cure even hardcore Apple addicts.

That is so Steve Jobs. He saw it faster than most of us.

Look, I appreciate what is palatably referred to as versioning, upgrades, and new releases. This is how companies make money, whether it's a 4G iPhone or the latest 4x4 with all the options. But in 2013, if it doesn't somehow make money for me, more or less immediately, having my head in "the cloud" takes on entirely new, and questionable, meaning.

Even fanatics like me clearly see no reason, just now, to replace our smart, stunning, lightweight iPhones and iPads for a still smarter, smaller, even lighter weight iPhone or iPad Mini. It's taken me until now to feel I've mastered most, but not all, of the dazzling so-called intuitive features, settings and apps in the products in which I invested only a year ago. I mean, how smart and intuitive can I get? I realize that a year to us mortals is a light-year in that parallel universe of planned obsolescence known as Silicon Valley, but I'm not prepared to jump up and down all over again over a fresh round of early-adopting handicaps with, for example, Google Glass -- a wearable computer with a head-mounted display (and cool acronym: HMD) to impress the yokels. As if texting-related fatal car accidents weren't enough.

In December, my office experienced an unexplained extreme power spike which blew out one of my entire Mac systems -- the wonderful workhorse Mac G5 PowerPC, along with its expensive THX quad-speaker sound system, 30" Apple Cinema Display, and the 9-year-old dual processor itself. Though I have the entire Apple ecosystem of phones, pads, pods and multiple Macs, I'd meticulously maintained the G5 to the limits of its operating system (10.5.8) , which remained very efficient and on which I continued to depend for earlier versions of certain software. It was cost-effective to goose the G5 far longer than the typical 3- to 5-year PC lifespan, despite incompatibility with newer, forced must-haves such as 1080 HD and iCloud -- it's fine; the iMac with the latest pussycat operating system covers all of that. I discovered that the G5 and everything associated with it, including my $1,200 thirty-inch Cinema Display, is "vintage" in Applespeak, as opposed to "toast."

Easy for them to say, but given that my high-end scanner and color laser printer were purchased at the same time as the G5, I was at the edge of compatibility with newer operating systems, looking at over $15,000 for either replacing the entire G5 system including scanner and printer, or doing without.

After three months of searching Apple user communities, resellers, surgery with tiny Phillips screwdrivers, testing, booting, unplugging, rebooting, retesting and $3,000 worth of replacement G5 chassis, displays, hard drives, cables and graphics cards, I raised the white flag and personally shlepped my fifty-pound G5 to the nearest Apple Retail Store for expert diagnosis -- my first foray into the wilds of cobalt-blue, polo-shirted, millennial Geniuses. Yes, I am that good as my own tech, and yes, we're talking desperation here.

I was clearly no genius, however, to not anticipate that the place would be a gauntlet on a federal holiday of wall-to-wall mall rats, prospective shoplifters, toddlers fiddling with tethered iPads and swarms of nervous hourly employees. Four times before I actually made it to the Experts in the back of the narrow Apple space, I was stopped by Geniuses asking if I needed help. "Yes," I finally said. "Do you have a tranquilizer?"

A path to the Expert was cleared for me. With the up-front caveat that I might have "bought someone else's problem" with any reseller replacement parts, he plugged what appeared to be a stethoscope into my sick G5 and after ten minutes pronounced, "Well, I can tell you it's not very happy." Meanwhile, the store manager distracted me by pitching something called the Apple Joint Venture, Apple's offering for post-warranty "vintage" systems and product support. "Joint venture?" I said without missing a beat, like Pavlov's dog. Apple knows the hooks. But at over $400 a year, that's no joint venture. That's called dealing in dependency, not unlike street corners in Compton.

I took my G5 back to the office and rebuilt the entire system, though it took another month and a bout of stress eczema. It's worked perfectly since. It was hard not to gloat when Apple announced yesterday that for the first time it needs to borrow with a bond offering, while mollifying investors with talk of dividend increases and other immediate rewards. As reported in yesterday's Wall Street Journal,

The company said it will boost its quarterly dividend by 15% to $3.05 a share, and it will spend $60 billion on stock buybacks through 2015, up from $10 billion announced last year. ...While the increased cash return was a step in the right direction, it still doesn't appear to give investors everything they want. "They want it all today," [a fund manager] said. "They want it faster."

It doesn't seem entirely coincidental to me that we're suddenly hearing about a possible early parole, you might call it versioning, for a certain former Enron CEO.

That is so Jeffrey Skilling. He wants it faster.