A new report exposes persistent segregation in the U.S. mortgage market and raises concerns that banks are engaging in racial steering and other discriminatory practices.

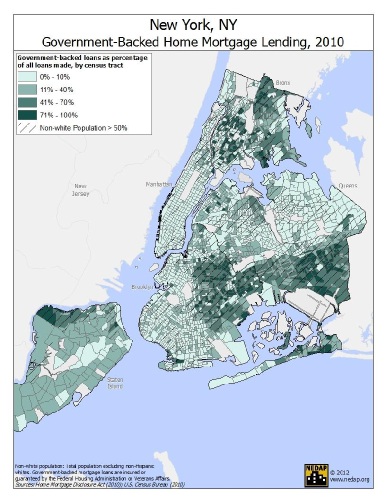

Black and Latino borrowers are far less likely than whites to receive conventional mortgage loans, according to the study, which examined home purchase and refinancing loans in seven cities. Instead, people of color disproportionately receive federally insured loans -- backed by the Federal Housing Administration (FHA) or Department of Veterans Affairs (VA) -- to purchase their homes and to refinance existing mortgages.

In New York City, for example, two out of every three home purchase loans made to black borrowers, and one in two loans to Latinos, are federally insured -- compared to just one in eight such loans made to white homebuyers. These racial disparities, which hold true across borrower income levels, raise concerns that lenders may be steering people of color who qualify for conventional loans into FHA or VA loans.

Federally insured loans offer clear advantages to banks and mortgage lenders, whose losses are covered by the FHA or VA if borrowers default on loans.

To be sure, federally backed loans can be beneficial for some families. They have lower down payment requirements, for example, than conventional loans. In the aftermath of the 2008 mortgage meltdown, the FHA in particular has played an expanded and vital role in preserving access to capital for working class homeowners and communities.

So what's the problem?

For starters, borrowers who qualify for conventional loans and receive FHA loans instead could pay higher costs, among other drawbacks. The long and fraught history of racial steering and other abusive practices by some FHA lenders and brokers also raises red flags about the renewed concentration of these loans in communities of color.

Moreover, the existence of a dual mortgage market is, in itself, problematic and warrants ramped-up enforcement of fair lending laws. Reckless and discriminatory practices often flourish in segregated markets -- as we learned most recently, and disastrously, from the subprime lending boom-turned-bust.

Lenders' overreliance on the FHA also raises broader questions about bank accountability, and the long-term prospects for mortgage credit in communities of color, as regulators and policymakers debate the future of FHA and the nation's housing finance system.

Weren't the banks, after all, bailed out to the tune of trillions of dollars, with the expectation they would make desperately-needed loans to aid a housing and economic recovery? Instead, they have decreased lending across markets, from small business to mortgage lending.

If banks are further restricting their lending in communities of color to loans that come with an explicit government guarantee, are they equitably meeting the credit needs in these communities? Or are the banks being let off the hook, yet again?