By Linda E. Brooks Rix

"It's unbelievable.... The whole government is a Ponzi scheme." ~ Bernie Madoff, as quoted in a New York magazine article, "The Madoff Tapes" (Feb. 27, 2011)

It takes one to know one.

In its Dec. 21, 2010 release, the Government Accountability Office (GAO) declared it cannot render an opinion on the 2010 consolidated financial statements of the U.S. federal government, because of "widespread material internal control weaknesses, significant uncertainties, and other limitations."

GAO found three primary obstacles, one being "the federal government's inability to adequately account for and reconcile intragovernmental activity and balances between federal agencies."

Intragovernmental fund transfers are what made it possible for the "Government of the United States" to land a spot on USASpending.gov as one of the top 100 prime contractors in fiscal year 2009 -- in position No. 22 -- behind companies like Booz Allen Hamilton and CH2MHill and ahead of DynCorp and Honeywell. Intragovernmental transfers between federal agencies account for billions in undisclosed fund shifts that are not contemplated in the appropriations process, are invisible to oversight parties, support programs that are off-the-books, and promote "no-year" money transactions that illegally carry funds Congress has appropriated for one fiscal year into the next.

For example, in an April 25, 2008 report, the Department of Defense inspector general stated that "...non-DoD agencies processed approximately 91,000 purchases [for DoD] ... valued at approximately $12.0 billion. Our audits revealed that DoD organizations continued to violate the bona fide needs rule and purpose statute when making purchases through non-DoD agencies leading to ... 493 potential Antideficiency Act violations. DoD organizations used prior year funds to purchase current year requirements. DoD organizations made advance payments to non-DoD agencies for goods and services not yet received."

And just as in Bernie Madoff's case, Antideficiency Act violations can be criminal conduct: "An officer or employee of the United States Government ... knowingly and willfully violating 1341(a) or 1342 of this title shall be fined not more than $5,000, imprisoned for not more than 2 years, or both."

This fiscal slight-of-hand is facilitated by "working capital funds" and "franchise funds" that are nothing more than a black box where money is "parked" -- shielding it from the eyes of appropriators -- money that should be returned to the Treasury as unspent instead of being carried forward. For agencies managing these working capital funds, it's a way to ensure a sufficient backlog exists to pay employees whose jobs are not authorized under normal appropriations -- what is termed a "fee-based" worker in the federal government.

Here's one example from a bidders' conference conducted by the Office of Personnel Management for its fee-for-service Training and Management Assistance (TMA) contract vehicle -- which OPM uses to sell services to other government agencies. An OPM official stated, "We operate under revolving fund authority, and what that means is that agencies can fund their projects by placing their money in a deferred account at OPM, and that money loses its fiscal year authority or fiscal year color, so that essentially, when we get large, multimillion dollar projects, they can be managed across fiscal years without agencies being afraid of losing the funding."

And just like any Ponzi scheme, it represents a false economy. When one government agency's payroll is dependent on another government agency sending it money in an intragovernmental fund transfer, the actual cost of government operations is completely cloaked. Add to it "fees" charged by the gaining agency -- falsely and disingenuously called "cost reimbursement" rather than profit -- and you have an invisible layer of overhead that sucks value from each taxpayer dollar engaged in this activity.

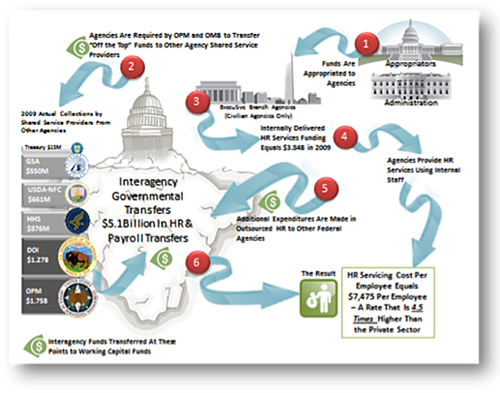

The graphic to the right depicts how much money can flow through interagency fund transfers in just one function, human resources -- $5 billion-plus even without DoD, which runs a sizeable franchise of its own for payroll services. The process bloats the cost of HR services to a point 4.5 times higher than you'd find in the private sector. What are these agencies doing in fee-based business enterprises that have nothing to do with their agency's mission anyway?

The graphic to the right depicts how much money can flow through interagency fund transfers in just one function, human resources -- $5 billion-plus even without DoD, which runs a sizeable franchise of its own for payroll services. The process bloats the cost of HR services to a point 4.5 times higher than you'd find in the private sector. What are these agencies doing in fee-based business enterprises that have nothing to do with their agency's mission anyway?

The government has an addiction to this underground source of payroll funding, providing incentive for federal employees to behave in a manner contrary to taxpayer interests. Instead of looking for opportunities to open competition for the best and lowest cost services and products, the government creates monopolies used to fund payroll for greater numbers of employees. It creates an extreme administrative cost burden on agencies and protects antiquated technologies (like COBOL payroll systems) that require millions annually just to keep them running. Alternatives, like cloud technologies, are suppressed to save the infrastructure of the monopoly enterprise. Not only does this contribute to a bloated bureaucracy, it creates opportunities for corruption, conflicts of interest, and waste.

A case in point comes from OPM again. The same OPM TMA official stated, "We suffered a real financial blow. And we realized that we had to take some drastic action in order to improve our financial viability. So we did a number of things. One is ... we revised it from a fixed rate of 12 percent ... we offered a temporary incentive of 6 percent fixed fee for any strategic HR management projects, because we needed to jump-start that business line, and it was very, very effective."

In contrast, the General Services Administration, an agency whose core mission is to offer contract vehicles and procurement services to the rest of government, has its fees capped at .75 percent to eliminate the unauthorized profiteering and carry-over of funds from one fiscal year to the next -- the same activity OPM is widely engaged in doing.

Intragovernmental transfers are the government's form of crack cocaine: Instantly addictive.

An agency like OPM can grow an entire organization without ever asking Congress to approve a budget, review its performance, or question its headcount -- in this case increasing employees by 2,700-plus between 1998 and 2010. Once it's set up, all OPM has to do is make sure the money supply keeps coming in ... or as happens sooner or later to all Ponzi schemes, the house of cards collapses, they're out of business, and they take everybody's money down with them.

Ponzi-style governance is alluring for many reasons -- in OPM's case, the ability to skim $1.7 billion in new payroll funding from other agencies -- a full 8.5 times the amount of money Congress sees fit to give OPM in appropriations.

Ironically, the recent threatened shutdown of the federal government shed light on an even more compelling reason agencies love interagency fund transfers.

"The Office of Personnel Management has released its contingency plan for operations during a shutdown. The plan says the agency will be able to continue many of its functions, even under a furlough situation caused by a lack of appropriated funds. According to the plan, the majority of OPM's functions are funded by sources other than annual appropriations, and thus would continue during a Government shutdown caused by a lapse in appropriations," GovernmentExecutive.com Editor-in-Chief Tom Shoop posted on the site's FedBlog.

"Indeed, four out of OPM's six core components perform functions that are funded through alternative sources ... the employees working in ... Employee Services and Merit System Accountability and Compliance -- [these functions are the core mission of OPM] -- perform functions that are funded from annually appropriated funds and would thus be furloughed. Furloughing these employees would mean that agencies and employees would not have access to OPM's expert guidance on HR matters that arise during a shutdown."

In other words, if your employees are paid based on skimming appropriated funds from other agencies, they get to keep working while that agency's employees are furloughed due to lack of appropriations. So, fee-based employees keep working, while the direct mission-based employees are furloughed.

That spells P-O-N-Z-I.

Here's one more consequence to supporting intragovernmental fund transfers. Another OPM official, in a transcript of a 2006 bidders conference, told a room full of contractors, "We're looking for stuff ... try to keep our numbers up ... some of the primes in this room showed up to the Monte Carlo Room, where you rolls the dice and takes your chances, and they were rolling the dice for seven figures-plus, perhaps seven figures a year for multiple years."

After the whole financial services mess, now we're told taxpayer money is in a casino after all? And it's considered house money, too. These schemes are playing roulette with taxpayer dollars. There is no return on investment, and no one is doing any oversight. Many of these fee-based organizations get to double down, too. How? OPM, as the government's HR regulator has an easy time coercing money from the agencies it regulates -- and like a greased pig, sliding out from under any allegations of corruption and any financial accountability.

At a Federal IT Acquisition Summit just held on April 26, agencies were encouraged by fee-based agencies to buy their contracting "expertise" -- by promoting the notion that smaller federal contracting offices need assistance in handling information technology acquisitions. The fee-based agencies charges fees for this "service".

Here's a quote from an April 26 article titled, "Smaller agencies that lack expertise could get help for a fee" on WashingtonTechnology.com: " 'Our biggest question that people are asking is, why are you charging that much?' said John Nyce, associate director in the acquisition services directorate of the Interior Department" -- a fee-based contracts shop at the Department of Interior.

Think about this next time there's a big oil spill in the Gulf of Mexico: The Interior Department's Minerals Management Service's fee-for-service operation funneled billions in contracts for DoD and other agencies -- including an infamous case where DoD used MMS's information technology contract to hire prison interrogators for DoD during the Iraq war. Where's the link between that and the MMS core mission of offshore drilling oversight and tax collection?

Given the current budget and deficit crisis, government needs to find savings fast and in large sums.

A good place to start is to cut off all franchise and working capital funds. Put the money back in the programs they were appropriated to support. How can anyone justify the layers of cost, the adverse impact of the U.S.'s poorly constructed financial statements, corrupt tactics, shady contracting, and illegal carryover of funds?

The government's logic?

As Bernie Madoff said from federal prison, "I was always able to rationalize it."

Linda E. Brooks Rix is co-CEO of Avue Technologies, a public sector human capital management solutions platform provider headquartered in Tacoma, Wash., and offices in Washington, D.C. Avue's flagship solution, Avue Digital Services® has been a Level 4, fully hosted solution that has been in production since 2001 with a 99-plus percent uptime.